Not known Details About Tax Accounting

Are you one of those local business owners who just enjoy reading spreadsheets? Me neither. Yes, your business's publications are a scorecard of how well you're doingbut if you're not a "numbers person," doing your accounting might appear as appealing as a root canal. Still, various other local business owner indicate to review their service funds but obtain captured up in the everyday and also never navigate to it.

Co-mingling costs and also earnings is an usual error in little company bookkeepingand one that will cause massive frustrations for your company in the future. Open up a service savings account as soon as you decide to go through with your start-up, and obtain a different organization charge card. This not just separates your accounts yet additionally helps your organization build its very own credit report score.

The 45-Second Trick For Small Business Bookkeeping Tips

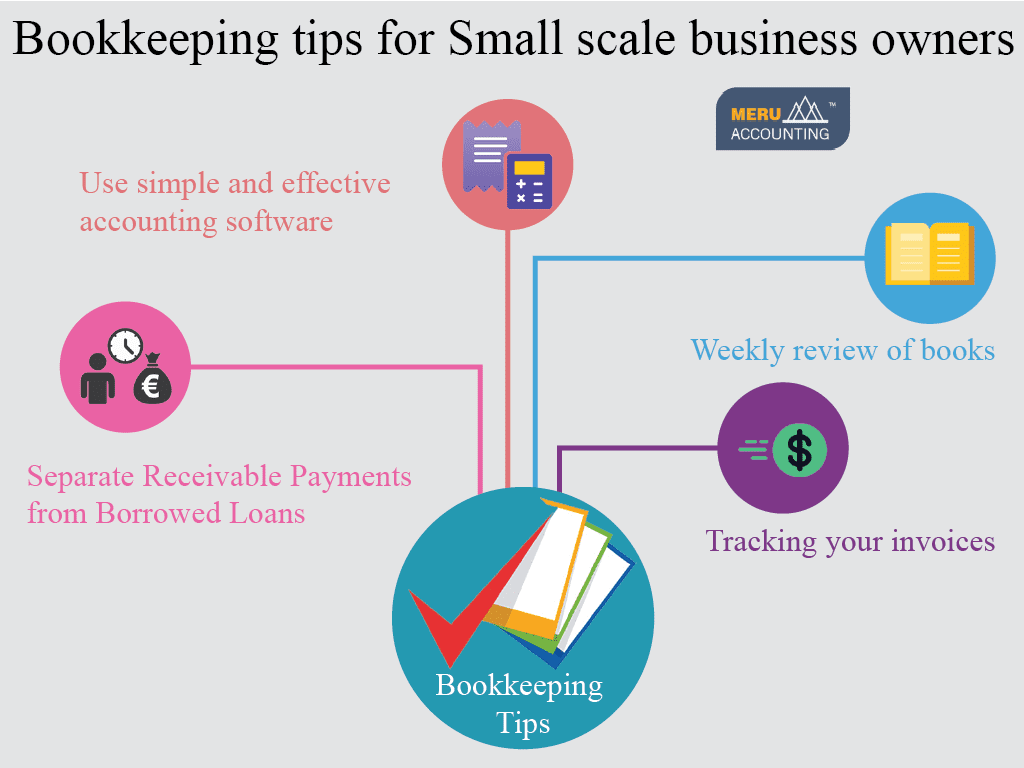

Usage cloud-based accounting software, and do your service financial online. By doing this, you can sync your bookkeeping software program with your organization checking account so you always have accurate, up-to-the-minute documents. Plus, with the cloud, your critical monetary data is supported securely off-site. Talk to your accountant to find out if you can utilize off-the-shelf audit software or if you would certainly profit from personalizing it.

If you put off accounting as well long, you finish up with jumped checks, overdue billings, or figures that do not add up. At the end of each quarter, take an in-depth look at your accounting and also bookkeeping documents.

If you put off accounting as well long, you finish up with jumped checks, overdue billings, or figures that do not add up. At the end of each quarter, take an in-depth look at your accounting and also bookkeeping documents.Accounting And Payroll Services Fundamentals Explained

Numerous changes to the tax code were made for 2018 that you ought to consult your accountant for assistance on what kinds of expenditures you can deduct following year. For anything you believe you'll be asserting, preserve thorough records; save time by scanning and also digitizing invoices. You can additionally streamline cost tracking by always utilizing an organization charge card for company acquisitions.

It doesn't simply conserve them hasslesit likewise makes your life simpler by instantly tracking overtime, PTO, etc. You can locate time monitoring software application made for just regarding any kind of market. Choose one that collaborates with your accounting software program, and payroll will be a breeze, too. When consumers do not pay promptly, your business's capital can dry up quick.

The Single Strategy To Use For Tax Accounting

Even if a customer is having economic problems, you might be her explanation able to establish up a payment plan to get at the very least some of what you're owed. To prevent obtaining captured short, strategy in advance and set apart cash for any kind of awaited tax expenses. If you do not have a mentor, what are you waiting for?.

See This Report about Open An Llc In Florida

These small company accounting ideas will assist you be effective with refining your daily accounts and also workplace management. These tips reveal you how to do accounting and also will boost your capacity and also understanding to operate your business with skill. All new local business owner have to make it a concern to for their business, ideally an account with on the internet gain access to, to keep business funds different from personal funds.

It's also worse if you are contracting out as well as paying an accountant to refine your accounts with these individual expenditures mixed in And they will certainly need to be refined if they are blended with business purchases. They have to be participated in the accounting system and also coded to drawings, using up priceless time that the bookkeeper might simply spend going into service data.

Examine This Report on Small Business Bookkeeping

Cost Savings Account, Also, open up a company financial savings account and also establish aside cash from your organization profits every month to pay your quarterly tax. Determine a portion (25-30%) of your Revenue and transfer it over before you invest it. Possibly do it the minute your consumer pays you.

Small Company Bookkeeping Tips # 2 A single trader or proprietor will certainly most likely take out funds from the business represent individual usage (illustrations). This can be done in location of paying themselves an income (but talk to your Accounting professional first). A good method is to transfer one amount regularly, such as when a week, from business account into the personal account.

The smart Trick of Accountant Kissimmee That Nobody is Talking About

The company account can stay good and also clean with only company transactions and also the one regular drawing quantity. This will likewise avoid the lure to assign a personal expenditure to the company. An entrepreneur requires to recognize as well as acknowledge what kind of costs can be declared against the profit to decrease tax obligation, and what can not be.

The company account can stay good and also clean with only company transactions and also the one regular drawing quantity. This will likewise avoid the lure to assign a personal expenditure to the company. An entrepreneur requires to recognize as well as acknowledge what kind of costs can be declared against the profit to decrease tax obligation, and what can not be.Mixing personal as well as organization does not imply a complete case for company can be made. Occasionally the owner will utilize their personal funds for service acquisitions.

Not known Facts About Open Llc

Freedomtax Accounting, Payroll & Tax Services

Address: 1016 E Osceola Pkwy, Kissimmee, FL 34744, United StatesPhone: +14075022400

Click here to learn more